26+ Loan comparison calculator

By default this calculator is selected for monthly payments and a 30-year loan term. He still owes a few thousand dollars on the loan and has to make car and student-loan payments.

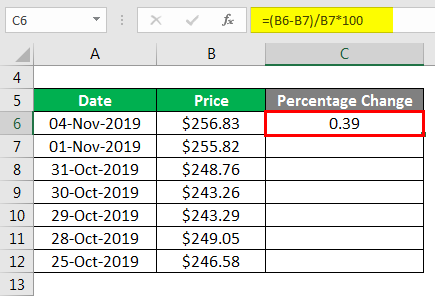

Percentage Change Formula Calculator Example With Excel Template

Bi-weekly Payments for an Auto Loan Calculator Overview.

. He gets roughly one offer a day in his mailbox from lenders encouraging him to borrow more. Principal paid and your loan balance over the life of your loan. Since its founding in 2007 our website has been recognized by 10000s of other websites.

Interest rates for housing loans in Malaysia are usually quoted as a percentage below the Base Rate BR. Home Loan Calculator - Fortnightly Repayments Calculator. View all Loan Calculators.

As of 2nd January 2015 Base Lending Rate BLR has been updated to Base Rate BR to reflect the recent changes made by Bank Negara Malaysia and subsequently by major local banks the interest rate on a BR. For example if the current BR rate is 400 Update. If you enter your current mortgage balance in the Loan Amount then enter the number of years you have left on your mortgage.

This comparison rate is true only for the examples given and may not include all fees and charges. What Is a PLUS. One year is assumed to contain exactly 52 weeks or 26 fortnights.

See how your loan balance decreases. Use this auto loan calculator to estimate your monthly payments and get an idea of how much financing your car may cost. To use the loan comparison feature follow these simple instructions.

Enter your loan amount. Our amortization schedule calculator will show your payment breakdown of interest vs. Enter your loan term.

The amount is based on an average weekly or fortnightly figure by taking the monthly amount x 12 then dividing by 26 or 52 to provide an approximation. Credit unions and online lenders to do some comparison shopping. Youll see a change show up in the Compare.

See the note under Compound Period. Term of Loan in Years. Several comparison sites online offer real-time interest rate quotes so you can compare and shop based on the loan criteria and your own financial and credit picture.

In fact you can compare up to four different loan scenarios at once. Since there are 52 weeks in the year your total number of payments when paying bi-weekly is 26 which actually includes more payments than a monthly schedule. Follow these steps to calculate the monthly payment and total cost of a personal loan.

As a result borrowers repaying bi-weekly make a full extra contribution to their mortgage repayment each year which gets applied directly to the principal balance of the loan. 26072012 Create Your Savings Plan Online New Savings Calculator Aims To Remove The Guesswork When Deciding How Much To Put Away For Future Goals. Enter the amount you want to borrow.

Your savings primarily come from the fact that paying every other week means youll be making 26 half-payments a year the equivalent of 13 monthly payments. A person could use the same spreadsheet to calculate weekly biweekly or monthly payments on a shorter duration personal or auto loan. COMPARISON RATE WARNING.

Loans Comparison Calculator Use Our Loan Comparison Calculator To Compare Payments and Costs with up to 3 Loans. Calculate your home loan repayments with our handy home loan repayment calculator. Use our handy Car Loan Calculator to estimate what your car loan interest rate and repayments could be.

One year is assumed to contain exactly 52. You wont believe the incredible savings ME has on offer. Click the blue Add result to compare button.

Mortgages usually have 15 or 30-year terms. Home Loan comparison rates are based on a loan of 150000 for a term of 25 years repaid monthly. Experian State of the Automotive Finance Market Report Q1 2021.

Get an Estimate of how much Your Home Loan Repayments will be with the Home Loan Repayment Calculator - Free for Non-Suncorp Customers Too. Our loan comparison feature makes it simple to see these costs in a side-by-side presentation. By making 26 fortnightly home loan repayments instead of 12 monthly payments youre essentially making one additional monthly payment off your loan a year shortening the life of the loan and lowering the amount you need to pay.

Some of Our Software Innovation Awards. This calculator assumes a fixed annual interest rate. The total number of years it will take to pay off the mortgage.

This implicitly assumes that a. How to use this personal loan calculator. Dan Behar took out a 7000 personal loan from American Express about two years ago to help pay for a move from Long Island to Brooklyn.

Comparison rate is calculated on a 30000 secured or unsecured loan over 5 years. Personal loans typically range from 2000 to 50000 though some providers offer loans as low as 1000 and as high as 100000. The comparison rate provided is based on a loan.

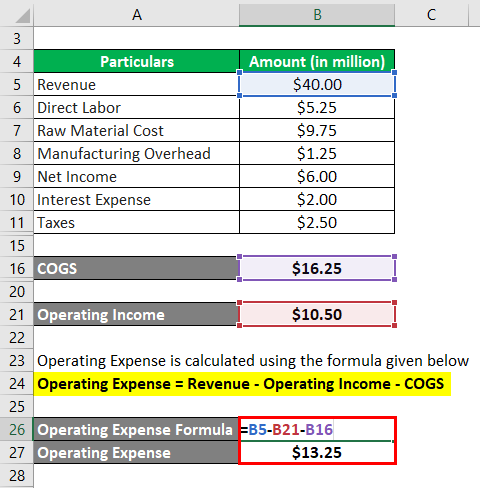

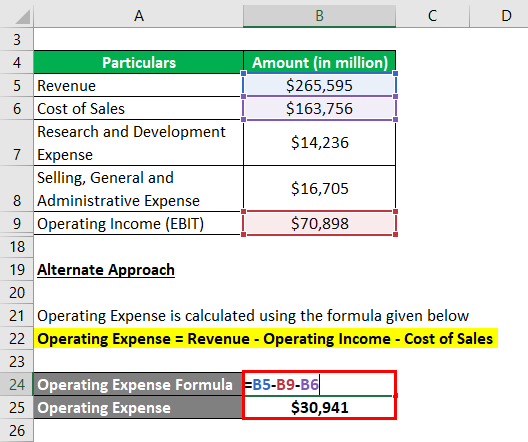

Operating Expense Formula Calculator Examples With Excel Template

Bid Ask Spread Formula Calculator Excel Template

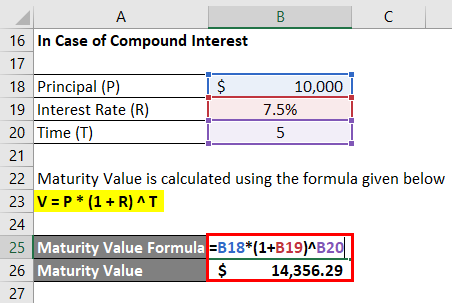

Maturity Value Formula Calculator Excel Template

Free Google Docs Budget Templates Smartsheet Budget Template Budget Spreadsheet Template Budget Template Free

Delta Formula Calculator Examples With Excel Template

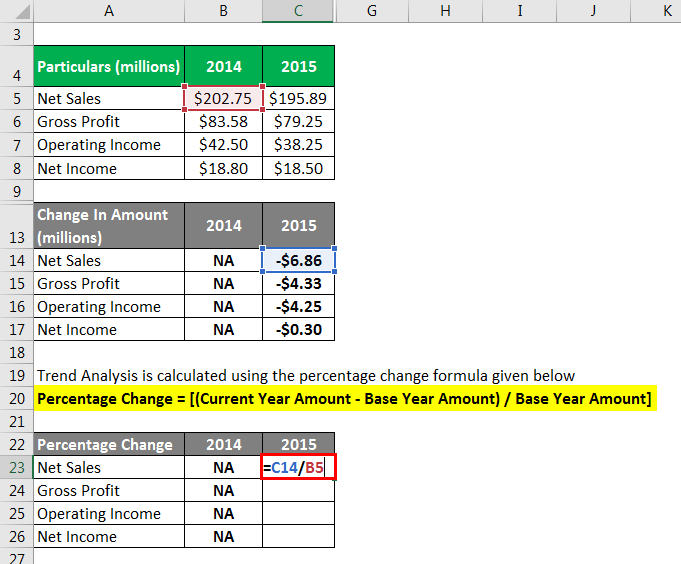

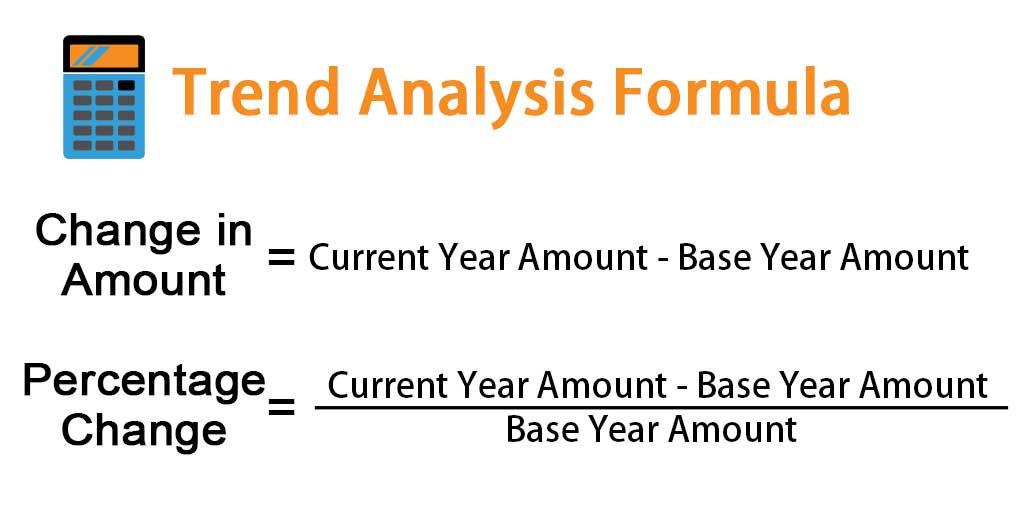

Trend Analysis Formula Calculator Example With Excel Template

Maturity Value Formula Calculator Excel Template

Retirement Calculator Spreadsheet Retirement Calculator Budget Template Simple Budget Template

Free Google Docs Budget Templates Smartsheet Household Budget Template Budget Template Budget Template Free

Operating Expense Formula Calculator Examples With Excel Template

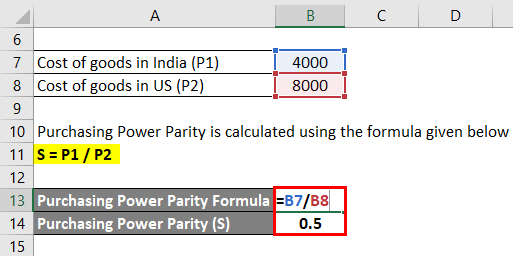

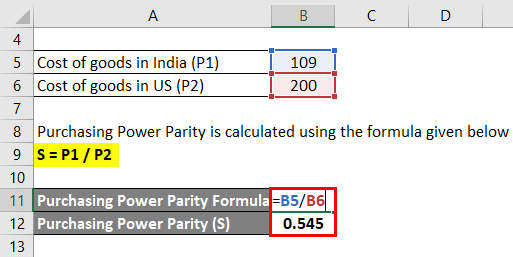

Purchasing Power Parity Formula Calculator Excel Template

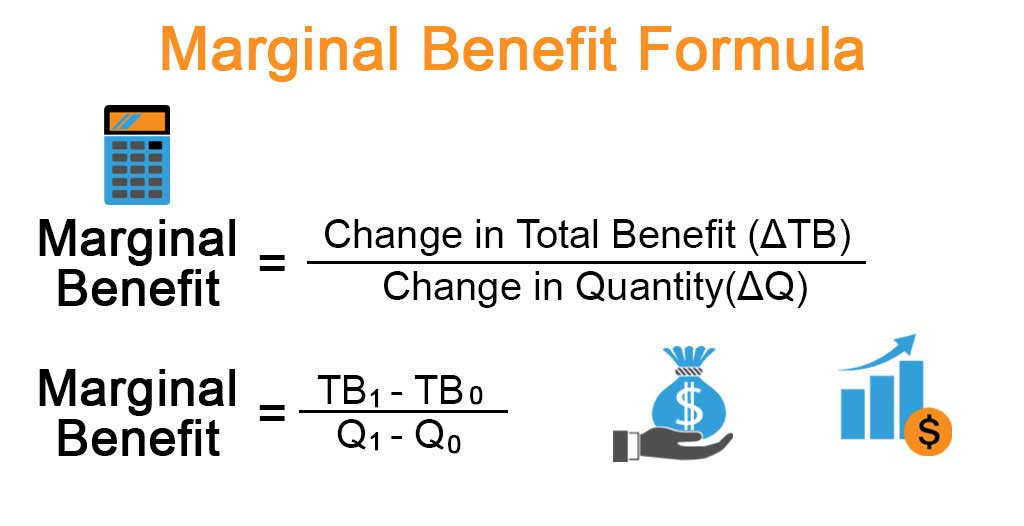

Marginal Benefit Formula Calculator Examples With Excel Template

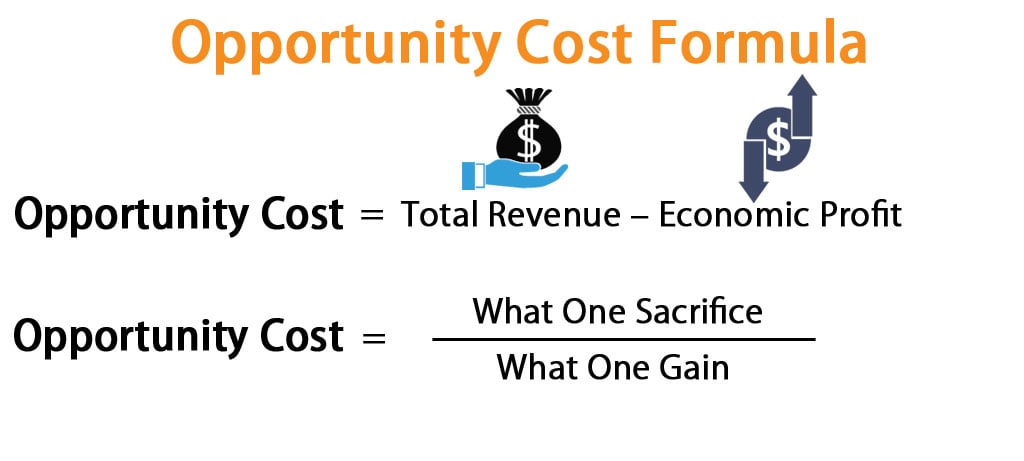

Opportunity Cost Formula Calculator Excel Template

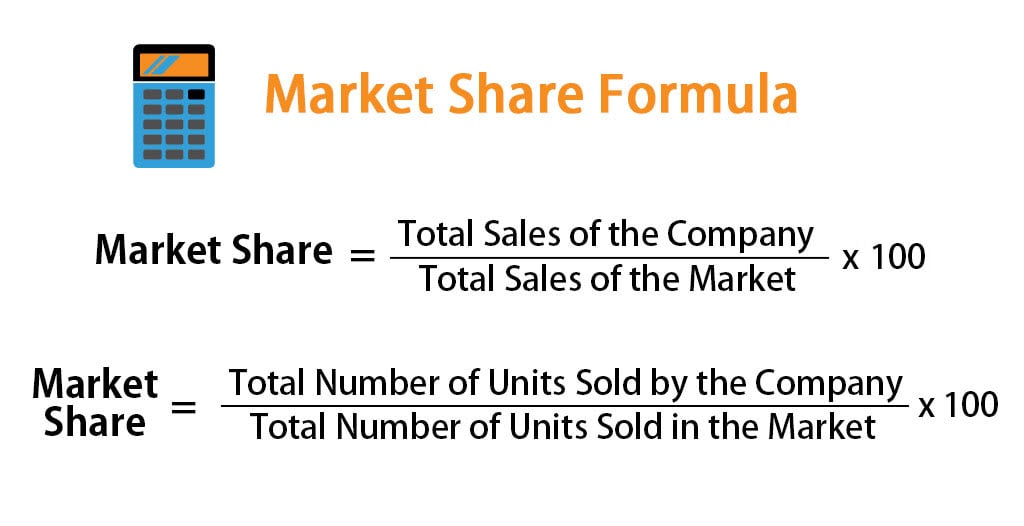

Market Share Formula Calculator Examples With Excel Template

Purchasing Power Parity Formula Calculator Excel Template

Trend Analysis Formula Calculator Example With Excel Template

Free Google Docs Budget Templates Smartsheet Budget Spreadsheet Template Monthly Budget Template Budget Template